Liabilities:

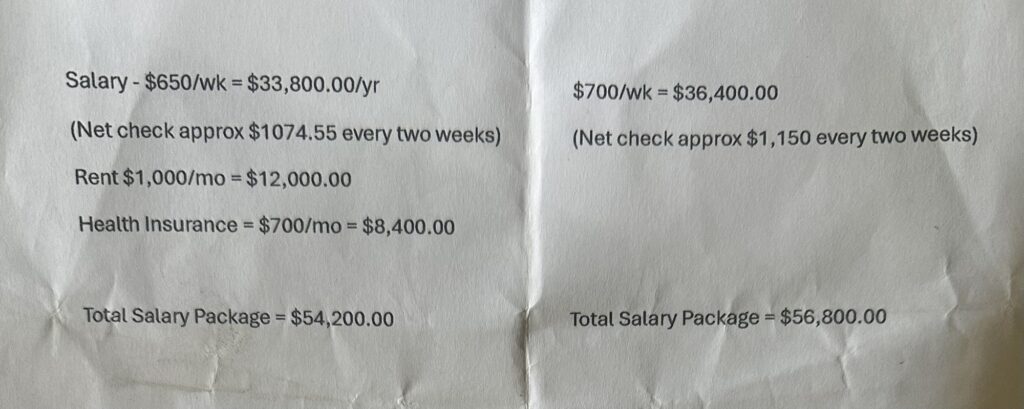

The above numbers indicate that (on rent plus health insurance,) I spend $1,700.00 per month which means that my money is being allocated from one place to another, but I never access or control that money.

The following numbers have been projected which suggest that I am a financial liability, as opposed to being an asset to the business:

| Liability: | Monthly: | Annually: |

| Rent | $1,000 | $12,000 |

| “Health Insurance” | $700 | $8,400 |

| Salary | $2,800 | $33,600 |

| TOTAL: | $4,500.00 | $54,000.00 |

I do not have any receipt of earning the above alluded to money, nor do I have a receipt to prove where I got that money from or which form of payment(s) I used when paying rent and health insurance.

I cannot prove that I am the person financially responsible for those expenses.

On paper, I am earning ,”$36,400.00″ per year and spending $20,400.00 per year, left with $16,000.00 for all other expenses.

However, I cannot claim those expenses, because I do not have any receipts for any of those transactions to produce when applying for a car loan or a line of credit.

I am being told that I am earning $36,400.00 per year and spending $20,400.00 per year, but I am factually earning, (roughly,) $27,600.00 per year and spending exactly $0.00 (zero dollars) per year on those two expenses.

When applying for a car loan, these are the two different sets of figures I may supply to the bank::

Earnings:$56,800.00 (consider that tax bracket!)

Rent: $12,000.00

Other expenses: $8,400.00

These are the True figures I can provide to the bank:

Earnings:$27,600.00 (consider that tax bracket!)

Rent: $0

Other expenses: $0

Total Expenses: $0

The numbers they provided me look good and work in their favor on a fiscal level, but the numbers do not benefit me in true life.